In April 2024, Saudi Arabia’s first electric vehicle brand and OEM, CEER, will cooperate with a Chinese company to construct an electric vehicle manufacturing factory. According to the Public Investment Fund (PIF), Saudi Arabia has a goal to produce 500,000 EVs yearly by 2030. In addition, in May, Adnoc Distribution, the state-owned oil company of the United Arab Emirates, announced that it will double the number of charging stations for electric vehicles by 2024. In a region that holds abundant petroleum resources, developing electric vehicles seems quite unusual. However, because of a major surplus of oil supply and energy system transformation, governments in the Middle East have begun to actively seek structural transformation to reduce oil dependence.

So far, countries such as Saudi Arabia, the United Arab Emirates, Qatar, and Kuwait have successively released the national vision documents for future development, which include measures of promoting the use of electric vehicles. These documents have also raised awareness of energy storage solutions and increased investment in the local new energy industry. Mordor Intelligence's analysis predicts significant growth in the Middle East electric vehicle market, rising from $2.7 billion in 2023 to $7.65 billion by 2028. Additionally, due to the arid climate in the Middle East, which has many deserts, it is particularly urgent to construct the charging stations and other infrastructure. Therefore, many countries in the Middle East not only release new policies to attract electric vehicle companies but also continuously invest in related industries to improve renewable energy generation proportions.

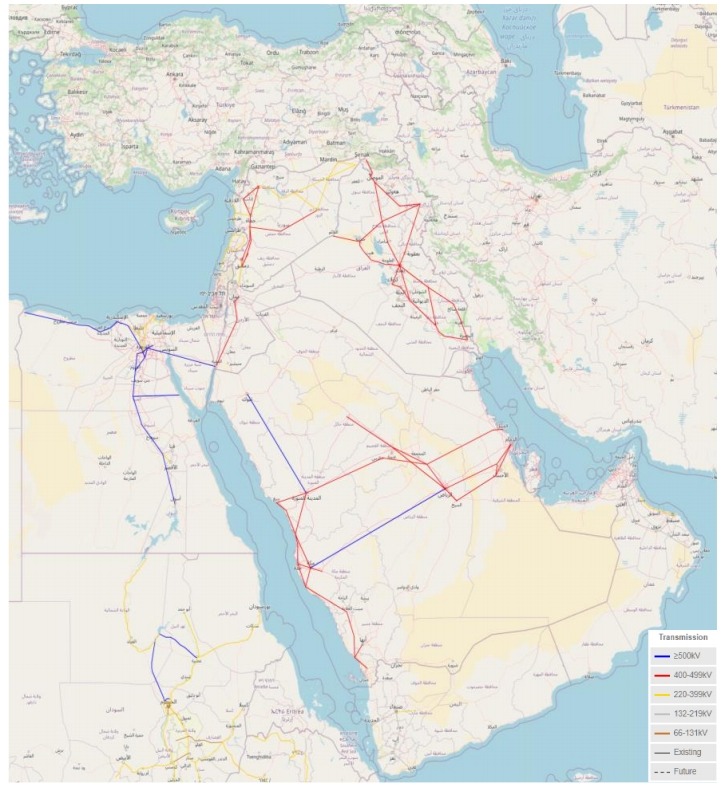

(Source: African Energy)

Over the past decade, the international situation has changed dramatically. Progress in the development of renewable energy in the Middle East has been slow. Consequently, the growth rate of installed renewable energy capacity in the region is significantly lower than the global average. According to the International Energy Agency’s (IEA) “Net Zero by 2050” roadmap and “The Sustainable Development Scenario,” the demand growth for coal and oil is expected to slow down in line with the carbon neutrality goal, with renewable energy gradually replacing fossil energy in the market. Several countries in the Middle East have committed to the Paris Agreement and joined the fight against climate change and net zero emissions. A key factor in the energy transition in this region is the development of smart grids.

Smart grids are modern power grids that offer solutions for aging power supply equipment. This technology provides upgrade options for traditional grids, enabling them to operate more efficiently and economically. Currently, the existing power grids in the Middle East mainly operate at voltage levels of 500 kV and below, with few cross-border transmission lines. In this region, industrial and residential areas have relatively more power transmission lines. However, in some areas, such as Iraq, Syria, and Iran, there are limited power connectivity exists due to political, economic, or geographical factors. Additionally, power connections between Middle Eastern countries and other countries in Africa or Asia are relatively few. Therefore, the market prospects for grid modernization in this region are broad.

In the Middle East, several countries are focusing on enhancing their energy infrastructure. Saudi Arabia is working on building an advanced transmission and distribution network. The Saudi Electricity Company plans to increase transmission capacity by developing smart grids, and aims to add 23,000 kilometers of transmission lines, and 259 transmission substations within the next five years. Iran is seeking up to $50 billion in investment for its power sector. The country primarily generates electricity from thermal power, natural gas, and hydropower. The government aims to add 5 GW of new energy generation within 20 years, expecting power generation and transmission to grow by 7% to 8% annually. The UAE aims to increase the share of renewable energy in its total energy mix from 25% to 50% by 2050, while reducing its carbon footprint by 70%. Kuwait is transitioning its power generation from oil to natural gas and solar energy, with the expectation that the share of oil in total energy demand will decrease to 42% by 2035, and solar power will account for 3%. Other Middle Eastern countries, such as Jordan, Turkey, Georgia, Israel, and Egypt, are also working on upgrading and modernizing their distribution networks, while encouraging renewable energy projects.

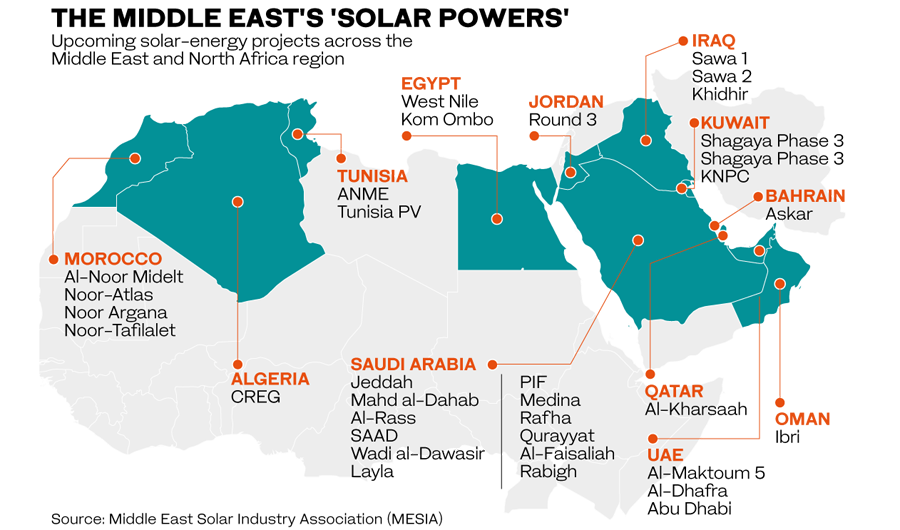

(Source: Middle East Solar Industry Association (MESIA))

The Middle East is rich in natural gas resources, but there is a growing interest in solar energy due to the region's average annual solar radiation of about 2000 kWh per square meter. The Middle East solar market is expected to exceed 11% CAGR by 2029, with solar photovoltaic being the main energy transformation strategy. Additionally, the market for power grid and related equipment is expected to see numerous opportunities, particularly in the field of transformers. With the modernization of local power grids and the development of the new energy market, Mordor Intelligence considers that the transformer market size in the Middle East and Africa is projected to reach $4.71 billion by 2029, with Saudi Arabia expected to be the dominant player.

CEEG, an international transformer manufacturing company, has 35 years of experience in transformer manufacturing. In addition to this, the company has been developing photovoltaic energy components and energy storage equipment in recent years. This year, our energy storage products were successfully sold in Israel, providing strong support for local energy development. The Middle East shows promising prospects for grid construction, and we are excited about the opportunity to supply energy equipment to this region. Our smart transformers, developed by an excellent research team, feature an intelligent operating system that not only adjusts voltage but also has anti-short circuit ability. Furthermore, our newly developed split-winding transformers, specifically designed for new energy, are particularly suitable for voltage regulation in photovoltaic power generation, and it can reduce maintenance costs. CEEG's products have been sold to more than 80 countries and regions, so we have extensive international cooperation experience. We are very much looking forward to collaborating with you.